orkestrboyan.ru Gainers & Losers

Gainers & Losers

What Is The Cost Of Quartz Per Square Foot

For instance, a low-quality quartz counter would cost $50 to $60 per sq. ft., while a high-quality quartz slab costs $70 to $ per sq. ft. Then for the mid-. Cost of Quartz Countertops by Crowley's Granite & Quartz - expert countertop installation, serving Oregon, Vancouver WA, and the surrounding areas. It really depends on the material and if it's a stock color. Standard granite can range anywhere from $$55 a square foot where as Quartz can. When calculating the quartz countertops' overall cost, assume that the lower-quality quartz will run between $55 and $75 per square foot. Higher quality quartz. Price reflects the cost per square foot installed. $ / sq. ft. Go for a clean look with the Arctic White Quartz Collection. It has a solid white color. Key Takeaways · Quartz countertops are a popular choice for modern homes due to their aesthetic appeal and durability. · The cost of quartz. Discovering the quartz countertops cost per square foot can help you budget for your expenses. Learn about the average price here. Quartz countertops start at $55/square foot installed on up depending on the stone you select. A few other items that factor into the cost of your new. “How much do quartz countertops cost?” Quartz slab cost: $ per square foot. So total cost for the slabs (″x63″, or sq ft per slab). For instance, a low-quality quartz counter would cost $50 to $60 per sq. ft., while a high-quality quartz slab costs $70 to $ per sq. ft. Then for the mid-. Cost of Quartz Countertops by Crowley's Granite & Quartz - expert countertop installation, serving Oregon, Vancouver WA, and the surrounding areas. It really depends on the material and if it's a stock color. Standard granite can range anywhere from $$55 a square foot where as Quartz can. When calculating the quartz countertops' overall cost, assume that the lower-quality quartz will run between $55 and $75 per square foot. Higher quality quartz. Price reflects the cost per square foot installed. $ / sq. ft. Go for a clean look with the Arctic White Quartz Collection. It has a solid white color. Key Takeaways · Quartz countertops are a popular choice for modern homes due to their aesthetic appeal and durability. · The cost of quartz. Discovering the quartz countertops cost per square foot can help you budget for your expenses. Learn about the average price here. Quartz countertops start at $55/square foot installed on up depending on the stone you select. A few other items that factor into the cost of your new. “How much do quartz countertops cost?” Quartz slab cost: $ per square foot. So total cost for the slabs (″x63″, or sq ft per slab).

The material portion of your new quartz countertops makes up about 30% of the total cost. So, if your new counter were to cost exactly $1,, $ of that is. For quartz costs you will pay between $$70 per square foot. Square Footage: Of course, your installation will cost more with larger amounts of counter space. The price of quartz countertops may vary based on the brand, quality, and installation requirements. Including installation, quartz countertops generally cost. For quartz countertops, you will spend between $70 to $ per square foot installed. With quartzite, prices start around $60 per square foot but it all depends. Most quartz countertops cost anywhere from $90 to $ per square foot. That's much higher than a laminate counter ($20 to $60 per square foot) or. In Virginia, the cost per square foot of quartz countertops can range from $50 to $ or more. This wide price range accommodates different preferences and. To give you a rough idea, quartz countertops typically range from $50 to $ per square foot. This price includes the material, fabrication, and installation. $/ Per Sqft. / Per Sqft. Next Step: Get Quotes from Local Countertop Installation Pros. While we have made this quartz countertop installation cost. $/ Per Sqft. / Per Sqft. Next Step: Get Quotes from Local Countertop Installation Pros. While we have made this quartz countertop installation cost. Ethereal Glow - 3 cm Quartz $ / Sq. Ft. Quartz countertops fall between $40 and $ a square foot, but most cost between $60 and $80 a square foot. The bulk of the cost is the fabrication, edge. In April the cost to Install a Quartz Countertop starts at $ - $ per square foot*. Use our Cost Calculator for cost estimate examples customized to. The price range for quartz countertops generally falls between $40 and $ per square foot, with most falling within the $60 to $80 range. The main components. Now, for the juicy part. As of , the average cost of quartz countertops is around $75 to $ per square foot installed. Quite the pretty penny. But, oh. This comprehensive guide aims to demystify the factors that influence the pricing of quartz countertops, compare them with other popular materials. The cost of quartz countertops per square foot ranges between $60 and $, with the average homeowner spending $95 per square foot. This calculation includes. Quartz Countertops: Buying Guide, Costs, and Care. With the look of natural stone, minus the maintenance, quartz countertops give granite a run for its money. 5) Multiply the number of square feet times the cost per square of the Silestone countertops you selected. Silestone countertops can range anywhere from $50 to. How Much Is a Standard Quartz Countertop? A standard quartz countertop can cost between $50 and $ per square foot, including installation. However, it's. Get free shipping on qualified Quartz Countertops products or Buy Online Pick Up in Store today in the Kitchen Department.

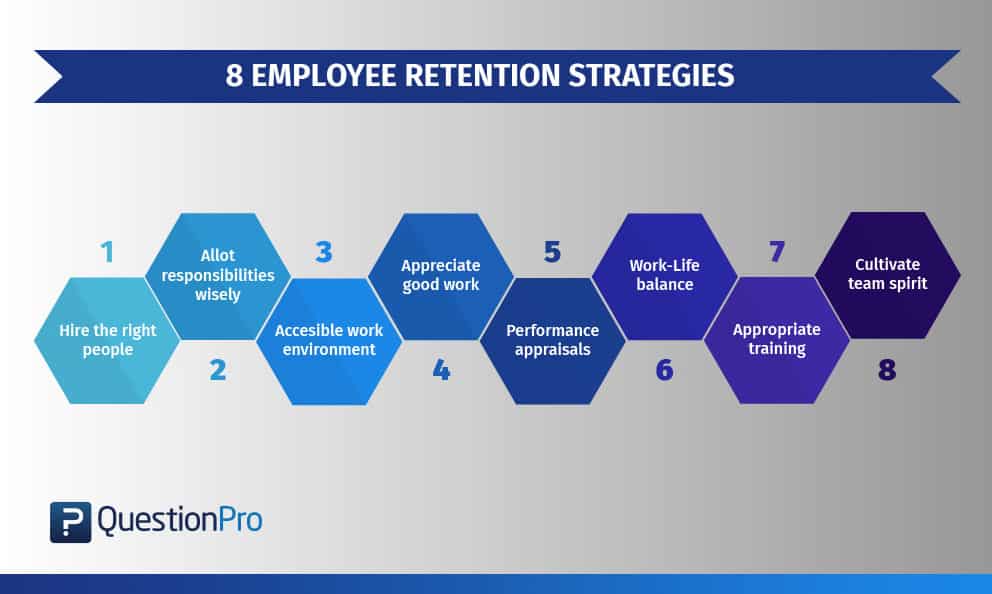

How To Retain Staff In A Culture Of High Turnover

High employee retention is typically achieved through various methods and compensation efforts, including benefits, competitive pay, a positive workplace. The best practice of best practices is to retain employees as much as possible, as small incentives that make employees feel appreciated and. Calculate employee turnover regularly to identify trends and root causes of your turnover issues. · Invest in career development programs to provide clear. If your company is experiencing high turnover rates, it's probably time to make changes internally. Rather than hiring replacements who exhibit the exact same. High-turnover companies have a hard time building the culture they want because there are fewer long-term employees to demonstrate the ideal behaviors. Although some employees thrive in a high-pressure environment, the ruthless and cutthroat culture can erode wellbeing and cause employee turnover. A report by. Understanding why employees leave is important to avoid a high turnover rate. By recognizing patterns of employee dissatisfaction, you can proactively make. 6 Strategies to Reduce Employee Turnover · Find the Right Talent · Encourage Retention Early On · Recognize and Reward Employees · Identify a Clear Career Path. Socialization. Turnover is often high among new employees. Socialization practices—delivered via a strategic onboarding and assimilation program—can help new. High employee retention is typically achieved through various methods and compensation efforts, including benefits, competitive pay, a positive workplace. The best practice of best practices is to retain employees as much as possible, as small incentives that make employees feel appreciated and. Calculate employee turnover regularly to identify trends and root causes of your turnover issues. · Invest in career development programs to provide clear. If your company is experiencing high turnover rates, it's probably time to make changes internally. Rather than hiring replacements who exhibit the exact same. High-turnover companies have a hard time building the culture they want because there are fewer long-term employees to demonstrate the ideal behaviors. Although some employees thrive in a high-pressure environment, the ruthless and cutthroat culture can erode wellbeing and cause employee turnover. A report by. Understanding why employees leave is important to avoid a high turnover rate. By recognizing patterns of employee dissatisfaction, you can proactively make. 6 Strategies to Reduce Employee Turnover · Find the Right Talent · Encourage Retention Early On · Recognize and Reward Employees · Identify a Clear Career Path. Socialization. Turnover is often high among new employees. Socialization practices—delivered via a strategic onboarding and assimilation program—can help new.

How to retain staff in a culture of high turnover? 1. Strengthen Employee In this section, we explore various strategies to prevent high turnover and ensure. A comprehensive employee retention program can play a vital role in both attracting and retaining key employees, as well as in reducing turnover and its related. A high retention rate is a great indicator of a solid business workplace culture. Retaining employees long-term indicates that company culture is healthy. Employee turnover is expensive. The process of recruiting and training an employee is not remotely cheap. The best practice of best practices is. Although some employees thrive in a high-pressure environment, the ruthless and cutthroat culture can erode wellbeing and cause employee turnover. A report by. Turnover also hurts productivity and results in the loss of institutional knowledge. To retain employees, businesses must do more than offer competitive. Provide flexible work policies · Improve manager-employee relationships · Prioritize professional development · Implement employee feedback · Foster team building. Creating a list or file of all past employees and noting their tenure and roles can help to identify potential causes for high turnover. This. Companies with high staff turnover can grapple with attracting and retaining top talent. How to Reduce Employee Turnover. There are several tools and. Businesses can reduce seasonal turnover by implementing effective retention strategies, such as providing a clear path for growth, offering competitive benefits. Companies with high staff turnover can grapple with attracting and retaining top talent. How to Reduce Employee Turnover. There are several tools and. Open Dialogue: Foster a culture of open communication where employees feel comfortable sharing their thoughts and concerns. Regular Feedback: Provide consistent. If your market research uncovers higher wages at other agencies or more PTO, consider offering your employees better incentives to keep them around. As you plan. High employee retention is typically achieved through various methods and compensation efforts, including benefits, competitive pay, a positive workplace. An employee retention program generally includes company policies and programs that help organizations attract and retain qualified employees. Some turnover is. Provide flexible work policies · Improve manager-employee relationships · Prioritize professional development · Implement employee feedback · Foster team building. A high employee turnover rate can be detrimental to any business; that's why in this post-pandemic job market, you must continually evaluate your employee. Constructive feedback and recognition for a job well done reduces turnover. Good communication between employees and employers makes a big difference in overall. How to Reduce Employee Turnover · Calculate employee turnover regularly to identify trends and root causes of your turnover issues. · Invest in career development. Creating a list or file of all past employees and noting their tenure and roles can help to identify potential causes for high turnover. This.

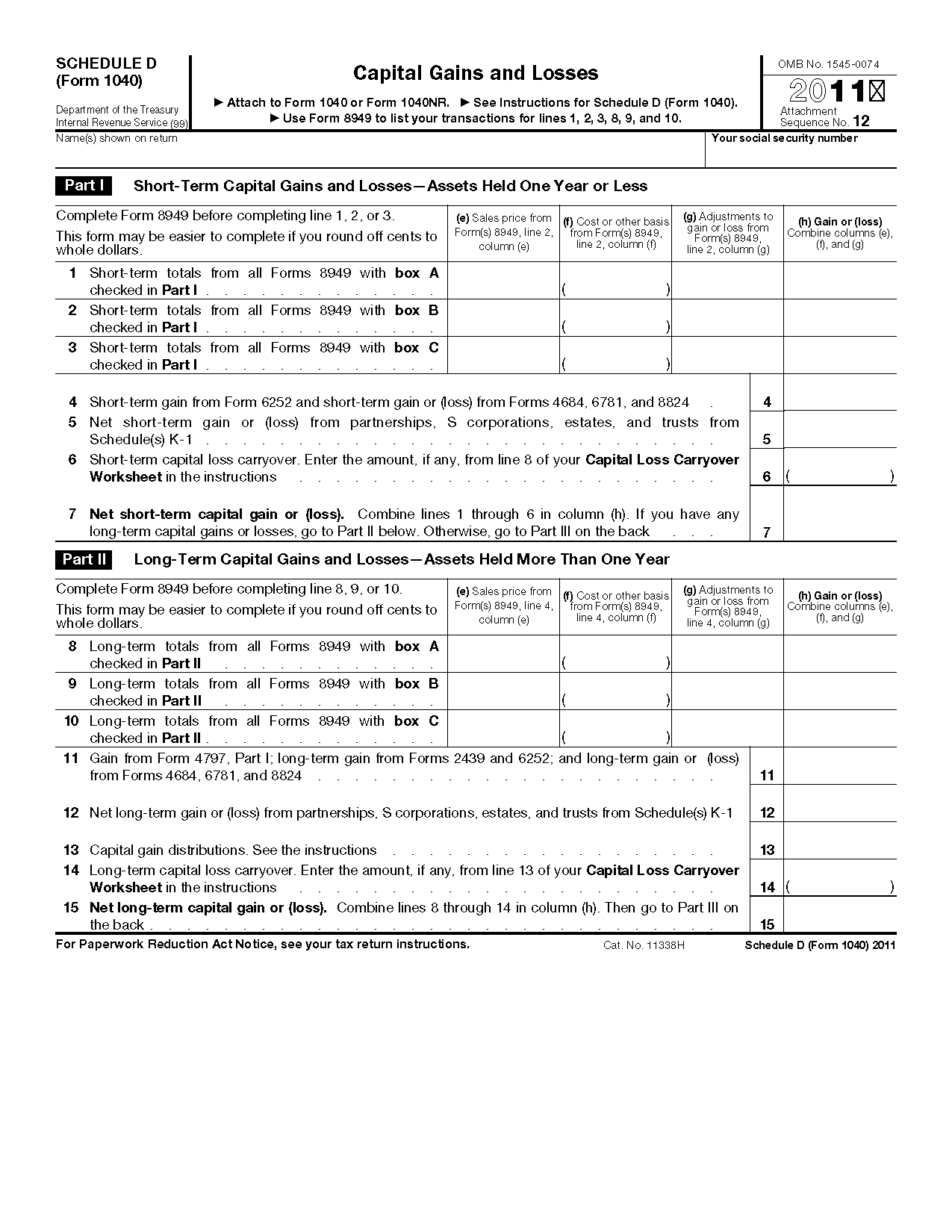

How To Claim A Loss On Taxes

Obtain a copy of Schedule E (Form ) from the IRS website or your tax preparation software. This form is used to report income or loss from rental real. If a Pennsylvania personal income tax taxpayer has gross taxable classes of income, such as interest and dividends, the taxpayer cannot deduct expenses incurred. If you have an overall net capital loss for the year, you can deduct up to $3, of that loss against other kinds of income, including your salary and interest. Corporations may deduct capital losses only to the extent of capital gains for the tax year. Unlike individual taxpayers, corporations may not deduct excess. You may be able to claim your loss as an NOL deduction. This deduction can be carried back to the past 2 years and/or you can carry it forward to future tax. You report your rental income and deductible expenses on IRS Schedule E. Often, you have a loss for tax purposes even if your rental income exceeds your. Discover how tax-loss harvesting—offsetting capital gains with capital losses—can lower your tax bill and better position your portfolio going forward. The IRS won't allow you to sell an investment at a loss and then immediately repurchase it (known as a "wash sale") and still claim the loss. If you buy the. Married taxpayers filing jointly may deduct no more than $, per year in total business losses. Individual taxpayers may deduct no more then $, If a. Obtain a copy of Schedule E (Form ) from the IRS website or your tax preparation software. This form is used to report income or loss from rental real. If a Pennsylvania personal income tax taxpayer has gross taxable classes of income, such as interest and dividends, the taxpayer cannot deduct expenses incurred. If you have an overall net capital loss for the year, you can deduct up to $3, of that loss against other kinds of income, including your salary and interest. Corporations may deduct capital losses only to the extent of capital gains for the tax year. Unlike individual taxpayers, corporations may not deduct excess. You may be able to claim your loss as an NOL deduction. This deduction can be carried back to the past 2 years and/or you can carry it forward to future tax. You report your rental income and deductible expenses on IRS Schedule E. Often, you have a loss for tax purposes even if your rental income exceeds your. Discover how tax-loss harvesting—offsetting capital gains with capital losses—can lower your tax bill and better position your portfolio going forward. The IRS won't allow you to sell an investment at a loss and then immediately repurchase it (known as a "wash sale") and still claim the loss. If you buy the. Married taxpayers filing jointly may deduct no more than $, per year in total business losses. Individual taxpayers may deduct no more then $, If a.

You must file the return that generates the loss prior to claiming the loss. The return that generates the loss can be filed at any time for purposes of. Claiming losses at tax time If you claim a loss in your tax return, you can carry it forward to lower your income in the next tax year — and therefore reduce. Corporations may deduct capital losses only to the extent of capital gains for the tax year. Unlike individual taxpayers, corporations may not deduct excess. How to Report a Casualty Loss to the IRS · If the property is not used for business or as an investment, it is classified as personal-use property. · Once you. If you incurred this type of loss, you can deduct it as one of these: Each of these casualties can be claimed as a casualty loss deduction via IRS Form Losses. If you make a tax loss, you can generally carry it forward and deduct it from income made in future years. You can claim losses for up to 4 previous tax years. Have a look at HS the loss itself can be carried forward indefinately. You are now to late. How to Take a Loss Deduction. Deduct a casualty or noncasualty loss on your tax return for the year the loss takes place. Deduct any costs you incur to. loss as a casualty loss on your federal income tax returns. As defined To claim the casualty loss, you need to file Form , Section A (personal. Losses. If you make a tax loss, you can generally carry it forward and deduct it from income made in future years. Can I write off gambling losses? You can deduct gambling losses if you itemize your deductions on your tax return, but you cannot deduct more than the. You can only deduct up to $, of business losses on your personal return (or $, if filing jointly). If your business losses exceed these limits, you. If you have more capital losses than gains, you may be able to use up to $3, a year to offset ordinary income on federal income taxes, and carry over the. You can claim a loss when you file an IR3 return the year after you made the loss. We'll then tell you how much of the loss you can carry forward. This is then. If your total taxable gain is still above the tax-free allowance, you can deduct unused losses from previous tax years. Claim for your loss by including it on. If you don't show that your business is starting to make a profit, then the IRS can prohibit you from claiming your business losses on your taxes. After you. Capital losses, where businesses that have a net loss for the year can deduct up to $3, in capital gains losses from their taxable incomes. Tax Cuts vs. Tax. The casualty loss deduction permits you to deduct an amount equal to the decline in the property's value due to a casualty. The IRS won't allow you to sell an investment at a loss and then immediately repurchase it (known as a "wash sale") and still claim the loss. If you buy the. (d) Loss of livestock—(1) Raised stock. A taxpayer engaged in the business of raising and selling livestock, such as cattle, sheep, or horses, may not deduct as.

Jeans For Curvy Body

Luckily we make the best jeans for curvy women. Our jeans will accentuate your body shape and allow you to flaunt your curves. We have a array of signatures. Shop Curvy Women's Jeans at Lands' End. Find the Best Curvy Women's Jeans/Curvy Straight Leg/Curvy Bootcut Jeans! Curvy Fit Jeans in Black & Blue at Lands'. Discover Good Curve —women's curvy jeans designed to enhance every curve in sizes Plus. Shop now for super high-rise jeans that fit and flatter from. Shop LOFT for curvy jeans in a variety of sizes and styles. Find curvy cropped and bootcut styles or skinny jeans designed to flatter curvy figures. Curvy Fit Jeans() · Jordache Women's Mid Rise Curvy Bootcut Jeans, Available in 30" and 32" Inseams · Sofia Jeans Women's Rosa Curvy Skinny High Rise Cha Cha. Enter H&M curvy jeans: designed for less gaping at the waist and more room in the thigh. Discover this hourglass fit in all your favorite denim cuts. Womens Jeans Baggy Barrel Jeans Summer Casual Denim Pants Cropped Mid Waisted Wide Leg Pant Plus Size Jeans. Generic · out of 5 stars (16). Get Curvy Fit Jeans from Target at great low prices. Choose from Same Day Delivery, Drive Up or Order Pickup. Free shipping with $35 orders. Expect More. What works best on my body is no-stretch jeans that hit at the natural waist and are snug enough not to pull down, and these fit the bill. Luckily we make the best jeans for curvy women. Our jeans will accentuate your body shape and allow you to flaunt your curves. We have a array of signatures. Shop Curvy Women's Jeans at Lands' End. Find the Best Curvy Women's Jeans/Curvy Straight Leg/Curvy Bootcut Jeans! Curvy Fit Jeans in Black & Blue at Lands'. Discover Good Curve —women's curvy jeans designed to enhance every curve in sizes Plus. Shop now for super high-rise jeans that fit and flatter from. Shop LOFT for curvy jeans in a variety of sizes and styles. Find curvy cropped and bootcut styles or skinny jeans designed to flatter curvy figures. Curvy Fit Jeans() · Jordache Women's Mid Rise Curvy Bootcut Jeans, Available in 30" and 32" Inseams · Sofia Jeans Women's Rosa Curvy Skinny High Rise Cha Cha. Enter H&M curvy jeans: designed for less gaping at the waist and more room in the thigh. Discover this hourglass fit in all your favorite denim cuts. Womens Jeans Baggy Barrel Jeans Summer Casual Denim Pants Cropped Mid Waisted Wide Leg Pant Plus Size Jeans. Generic · out of 5 stars (16). Get Curvy Fit Jeans from Target at great low prices. Choose from Same Day Delivery, Drive Up or Order Pickup. Free shipping with $35 orders. Expect More. What works best on my body is no-stretch jeans that hit at the natural waist and are snug enough not to pull down, and these fit the bill.

Find amazing products in Curvy Fit Jeans' today | Silver Jeans US New. Made in sizes Curvy jeans offer more room in the hips and thighs while contouring your body. Buckle offers a variety of jeans in all washes, colors, styles and fits - including jeans for curvy women. Our women's curvy jeans are a designed to look. High Waisted Curvy Jeans · Women's Sonoma Goods For Life® High Rise Curvy Straight Jeans · Women's LC Lauren Conrad Curvy High Rise 5-Pocket Skinny Jeans. Shop Women's Curvy Jeans and see our entire collection of women's high-waisted curvy jeans and more. Free shipping & returns for Madewell Insiders. Filters Forget ordinary plus-size pants for women. Every inch of our curvy denim pants is made for full-figured women. From unique sizing to a higher tapered. For jeans that not only flatter your bod but make you feel + look fabulous, Old Navy is the spot! Dive into our collection of curvy jeans for women made with. Snag a pair of comfy curvy jeans for women at Hollister with more room in the hips and thighs for a feel good fit. Available in a range of styles. Lightweight fabric with stretch that makes this work jean feel like an everyday jean. Light hand sanding and whiskering gives a more fashionable appearance. Our jeans for curvy women and teens are made to combine genuine comfort and real style, providing a perfect jeans profile that enhances any look. Shop the best jeans for curvy women at Abercrombie & Fitch. Explore our wide selection of washes, styles & lengths to compliment any outfit! Whether you're looking for a skinny jeans, bootcut style, or even shorts, we've got you covered. And with a variety of washes to choose from. Shop Ann Taylor's curvy fit jeans. In irresistible styles and colors, our women's curvy jeans are the best jeans for curvy women - find your pair today! For an even comfier fit, our Curvy Cheeky® Jean is made with organic cotton and Roica® V yarn, the world's first stretch yarn that isn't made with harmful. Stylish, high-quality women's curvy jeans. Ultra high rise & contour comfort waistband to embrace your natural curves. Wide range of styles, washes. Whether you prefer high-waisted, mid-rise, or straight-leg styles, our curvy jeans are designed to accentuate your curves in all the right places. With a. Shop Lane Bryant's Curvy Fit for plus size jeans for curvy women. Our jeans are made with a smaller waist and curvy hips & thighs for the perfect fit. Shop women's curvy jeans -- a perfect fit to flatter in all the right places. Plus, skinny and bootcut denim at New York & Company. Petite & Tall available. Celebrate your curves with Macy's Women's Curvy Jeans, offering specially designed styles to enhance and flatter your natural shape. Shop now. Shop White House Black Market for a collection of curvy fit jeans that are designed to hug you in all the right places. Free shipping for WHBM Rewards.

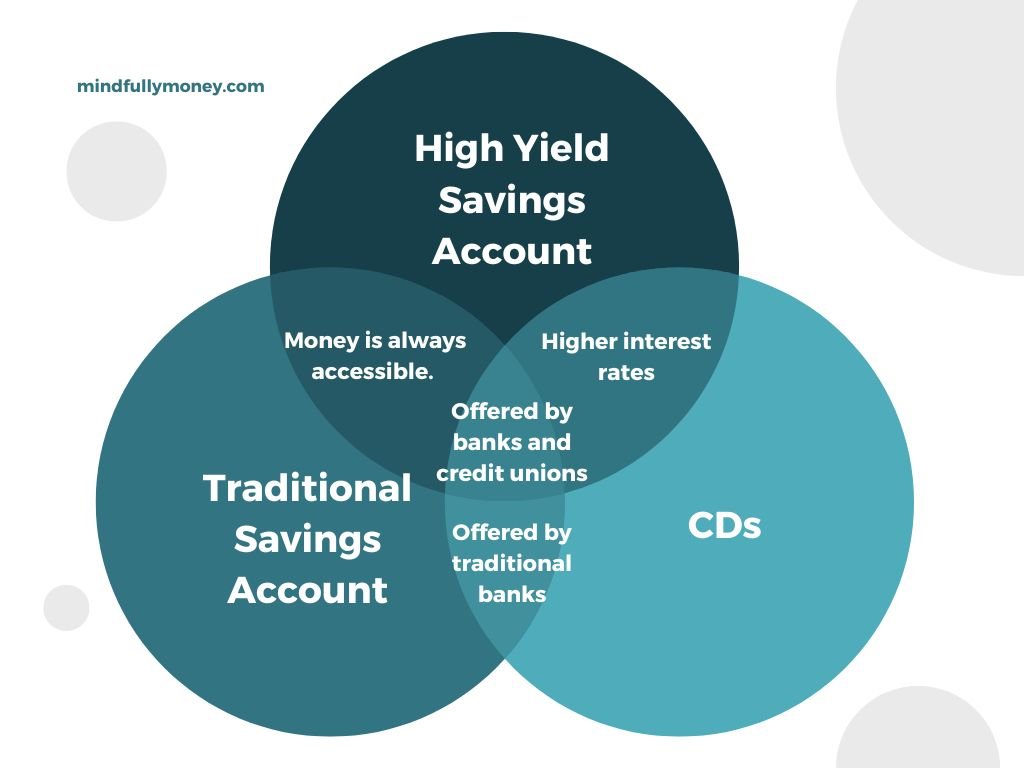

High Yield Savings Cd

The best rate we've found is % APY from California Coast Credit Union Celebration Certificate. However, the credit union has a small footprint for eligible. A CD is a great savings tool for your long-term financial goals. When We'll make sure you receive the CD's interest on a regular basis. Manage. Score big when you earn % APY* with a high-yield savings account. Win with a higher fixed interest rate on a CD at % APY** for 7 months. For High Yield Savings Accounts, the rate may change after the account is opened. For CDs, the APY assumes that principal and interest will remain on deposit. Grow your savings with BMO's high-yield, online-only CDs. No minimum balance, $0 minimum opening deposit, 6 available fixed terms, and interest paid monthly. With a Certificate of Deposit or a Solutions Money Market account, you can take advantage of the current financial climate. They're both high-yield options. The best CD rates of are as high as % APY. The highest rate is offered by CommunityWide Federal Credit Union on a 6-month certificate. Review Bank of America's interest rates and annual percentage yields (APYs) for checking, savings, CD and IRA accounts specific to your area. A Marcus High-Yield CD is a type of deposit account that, depending on the term, usually offers a higher Annual Percentage Yield (APY) than a traditional. The best rate we've found is % APY from California Coast Credit Union Celebration Certificate. However, the credit union has a small footprint for eligible. A CD is a great savings tool for your long-term financial goals. When We'll make sure you receive the CD's interest on a regular basis. Manage. Score big when you earn % APY* with a high-yield savings account. Win with a higher fixed interest rate on a CD at % APY** for 7 months. For High Yield Savings Accounts, the rate may change after the account is opened. For CDs, the APY assumes that principal and interest will remain on deposit. Grow your savings with BMO's high-yield, online-only CDs. No minimum balance, $0 minimum opening deposit, 6 available fixed terms, and interest paid monthly. With a Certificate of Deposit or a Solutions Money Market account, you can take advantage of the current financial climate. They're both high-yield options. The best CD rates of are as high as % APY. The highest rate is offered by CommunityWide Federal Credit Union on a 6-month certificate. Review Bank of America's interest rates and annual percentage yields (APYs) for checking, savings, CD and IRA accounts specific to your area. A Marcus High-Yield CD is a type of deposit account that, depending on the term, usually offers a higher Annual Percentage Yield (APY) than a traditional.

APY ; CFG High Yield Money Market Online and In Branch*, $1,, $1,+, %, % ; 12 Month CD Online and In Branch, $, $, %, %. Count on guaranteed returns to reach your savings goals · %APY Opens modal dialog · %APY Opens modal dialog · %APY Opens modal dialog · %APY Opens. CDARS® CDs · 1 year, $12M % · 2 year, $1M % · 3 year. Savings Accounts * ; Eagle Savings, $, % ; Eagle Retirement Savings, $, % ; Eagle High-Yield Savings Account*. Today's CD Special Rates ; 4 month · % · % · % · % ; 7 month · % · % · % · % ; 11 month · % · % · % · %. The best CD rates today are above 5% for one-year terms and above 4% for three- to five-year terms. CDs provide a boost to savings, with certain limits. Earn more with competitive rates. Open a high-yield FDIC-insured Certificate of Deposit (CD) with as little as $1, and enjoy predictable returns, fixed rates. FAQs · High Yield CD – terms range from 3 to 60 months. · Raise Your Rate CD – 2- and 4-year terms available. · No Penalty CD – month term that lets you. Through the CDARS program, enjoy the safety of FDIC insurance even on deposits of more than $,, while you earn competitive CD interest with a trusted. Park your money for a term, and earn higher interest rates than you would with a savings account. IRA CDs. Increase your retirement fund with this easy, low-. Annual percentage yield (APY)1: % · Available with a Citizens Quest® or Citizens Private Client™ Checking account · Early withdrawal penalties may apply. Popular Direct offers great interest rates for high-yield savings accounts and CDs with a simple banking experience. Get the best investment rates and. A high-yield savings account (HYSA) is very similar to a traditional savings account, but a HYSA gives you the opportunity to earn a higher yield. For high-yield savings accounts, a minimum of $ is required and must be deposited in a single transaction. For high-yield savings accounts, the rate may. Check out the latest CD rates offered by Ally Bank. Features include daily compounding interest and 10 day best rate guarantee. Ally Bank, Member FDIC. If rates go up annually by %, the long term CD will earn the most over the 3 years · General Info · Savings Account · Short Term CD · Long Term CD. CIT Bank offers High Yield Savings, Money Market, CDs and Custodial Accounts designed to help you maximize your personal finances. Member FDIC. A certificate of deposit typically earns higher interest than a traditional savings account. View Bank of America CD rates and account options. Fixed Rate Certificate of Deposit (CD) accounts earn a fixed interest rate for the selected term and the applicable rate is paid until the CD matures. Term accounts are similar to a high-yield CD account, and are also referred to as share certificates. Your funds will earn a steady, competitive APY.

Mms Marketing Software

An MMS service like Sakari allows you to add picture messaging to your SMS marketing strategy. Send your contacts visually detailed information or fun messages. Since the messaging fees for SMS and MMS aren't included within the software fee, users pay per message sent and received. Compared to other software providers. Learn what MMS marketing is and how you can use our multimedia messaging software to engage with your customers and grow your business. If you're on a lower pricing plan with this SMS marketing program, you won't be able to send MMS messages, schedule recurring texts, run drip campaigns, or. ClickSend is a cloud-based program that lets you send bulk MMS marketing campaign to your audience, giving you real results. Sign up for your free trial! It's highly effective for engagement, offering a more interactive experience than traditional SMS marketing. You can include several forms of engaging media in. You can start sending bulk SMS and MMS with OneSignal! Our free platform will help you get set up in as little as 15 minutes. MMS text messaging marketing is the method of sending bulk text messages with pictures or videos. Trumpia's MMS includes automation, integrated mass testing. Trumpia's MMS Messaging software includes automation, two-way-MMS messaging, and many other advanced multimedia functionalities. Start a day FREE trial. An MMS service like Sakari allows you to add picture messaging to your SMS marketing strategy. Send your contacts visually detailed information or fun messages. Since the messaging fees for SMS and MMS aren't included within the software fee, users pay per message sent and received. Compared to other software providers. Learn what MMS marketing is and how you can use our multimedia messaging software to engage with your customers and grow your business. If you're on a lower pricing plan with this SMS marketing program, you won't be able to send MMS messages, schedule recurring texts, run drip campaigns, or. ClickSend is a cloud-based program that lets you send bulk MMS marketing campaign to your audience, giving you real results. Sign up for your free trial! It's highly effective for engagement, offering a more interactive experience than traditional SMS marketing. You can include several forms of engaging media in. You can start sending bulk SMS and MMS with OneSignal! Our free platform will help you get set up in as little as 15 minutes. MMS text messaging marketing is the method of sending bulk text messages with pictures or videos. Trumpia's MMS includes automation, integrated mass testing. Trumpia's MMS Messaging software includes automation, two-way-MMS messaging, and many other advanced multimedia functionalities. Start a day FREE trial.

Sender is one of the most cost-efficient text message marketing platforms, offering an intuitive user experience and seamless SMS marketing automation. Via the ClickSend online dashboard or API you can send mass MMS messages to your audience in seconds. That could be thousands of images, coupons or GIF files to. For US programs, SMS Marketing also includes MMS. Use MMS to add an image or GIF to your text messages. Like email contacts, SMS contacts are stored in your. Use Callhub's MMS marketing software to add images, videos, gifs, and more to your texts. Boost engagement and the impact of your campaigns. With Textdrip, you can send MMS messages to boost interactiveness with visual elements and increase the text message character limit. Learn what MMS marketing is and how you can use our multimedia messaging software to engage with your customers and grow your business. Mailchimp is a multichannel marketing platform, and SMS marketing is available as an add-on for all paid Mailchimp plans. Use SMS (and MMS where available) to. Our guide has all the information you need to understand both text message formats, the benefits of MMS, and the best campaigns to put MMS messaging to use. MMS messages are more likely to attract engagement than standard SMS. Compared to SMS, MMS messages average click-through rate is 15% higher with up to 20% more. Best SMS Marketing Software At A Glance ; Best for Small Businesses: Birdeye ; Best for Mid-Market: Insider ; Best for Enterprise: Netcore Customer Engagement and. Our MMS marketing platform helps you cut through the noise and instantly engage customers with dazzling, personalized visual experiences. Here are the best SMS marketing software - 1. Omnisend 2. SlickText 3. Trumpia 4. Sakari orkestrboyan.rugic 6. EZ Texting. It's one of the most sought-after features in any text marketing platform as it helps save time, reach multiple people at once, and reduce costs as well. MMS. Everything you need for SMS and MMS messaging. Get an instant FREE text number and you can send your first messages in seconds! Discover the Best SMS Marketing Software Platform for your business. Increase customer engagement with our Text Message Marketing Software. With features like automated messages, multimedia messaging service (MMS) Text messaging software is a versatile tool that significantly benefits marketing. In contrast, Textline's base rate is $ per month with no text credits included; instead, there are varying rates for sending and receiving SMS and MMS. Textline By Textline, Inc. Secure HubSpot SMS & MMS texting for sales, support, and marketing Email Marketing Software · Lead. MMS Marketing Software. Multimedia Messaging Made Simple. Make your messaging memorable with our intuitive yet innovative MMS texting platform. Featuring fast registration and powerful tools, EZ Texting is the best mass texting service for sending bulk SMS marketing messages and MMS messaging.

Best Refinance Rates For Veterans

VA Streamline Refinancing Benefits ; $, loan at percent interest rate, $1,, $, ; $, loan at 7 percent interest rate, $1,, $, We specialize in finding you the right military mortgage and focus on a seamless process, which means less stress for you. Current VA Mortgage Rates ; Year VA Cash-Out Refinance, %, % ; Year VA Cash-Out Jumbo Refinance (Based on a $, loan amount), %, %. Best VA Loan Rates for to Credit Score · Learn More – Veterans Who Don't Shop Around Pay Higher VA Mortgage Rates! · Best VA Loan Rates for to New purchases under the First Home Limited, Veterans First Home Limited, and Veterans Mortgage Programs will receive these lower rates. Streamline. Currently, the home loan program offers eligible veterans fixed-rate financing for: · Owner-occupied, single-family residence · Up to the Fannie Mae limit. Compare 5 Best VA Loan Rates of ; Veterans United, %, % ; USAA, %, % ; Navy Federal Credit Union, %, % ; Quicken Loans, %. A VA loan is almost always the best type of mortgage you can get if you're eligible. The catch is that these mortgage loans are limited to qualifying veterans. Interest rates as low as %* · % APR* · Get Started · Resources. VA Streamline Refinancing Benefits ; $, loan at percent interest rate, $1,, $, ; $, loan at 7 percent interest rate, $1,, $, We specialize in finding you the right military mortgage and focus on a seamless process, which means less stress for you. Current VA Mortgage Rates ; Year VA Cash-Out Refinance, %, % ; Year VA Cash-Out Jumbo Refinance (Based on a $, loan amount), %, %. Best VA Loan Rates for to Credit Score · Learn More – Veterans Who Don't Shop Around Pay Higher VA Mortgage Rates! · Best VA Loan Rates for to New purchases under the First Home Limited, Veterans First Home Limited, and Veterans Mortgage Programs will receive these lower rates. Streamline. Currently, the home loan program offers eligible veterans fixed-rate financing for: · Owner-occupied, single-family residence · Up to the Fannie Mae limit. Compare 5 Best VA Loan Rates of ; Veterans United, %, % ; USAA, %, % ; Navy Federal Credit Union, %, % ; Quicken Loans, %. A VA loan is almost always the best type of mortgage you can get if you're eligible. The catch is that these mortgage loans are limited to qualifying veterans. Interest rates as low as %* · % APR* · Get Started · Resources.

The national average year VA refinance interest rate is %, up compared to last week's rate of %.

Current VA Mortgage Rates ; NBKC Bank. NMLS # · % · %; Points ; First Federal Bank. NMLS # · % · %; Points ; Farmers Bank. We specialize in finding you the right military mortgage and focus on a seamless process, which means less stress for you. NewDay USA is a VA home loan mortgage lender that offers streamline refinance, zero down loan, and other options for qualified Veterans. Veterans, Military Members and their spouses may receive up to $, on a fixed-rate loan for 15, 20, 25 or 30 year terms*. Veterans with a VA service. Current Mortgage Refinancing Rates ; VA Loans · % · % ; VA Streamline (IRRRL) · % · % ; Military Choice · % · % ; Conventional Fixed Rate. Navy Federal Credit Union: Best for refinancing with military ties. Cons ; Navy Federal Credit Union. VA IRRRL; Military Choice; Conventional refinance; Cash-out refinance; Adjustable rate. ; PenFed. VA IRRRL; Conventional. Eligibility and Bond Type Information · All veterans. · Limited funds are available for veterans who do not qualify for Qualified Veterans Mortgage Bond Program. No downpayment required · Competitively low interest rates · Limited closing costs · No need for Private Mortgage Insurance (PMI) · The VA home loan is a lifetime. What Are the Best VA Loan Lenders? · New American Funding · Rocket Mortgage · NBKC Bank · Farmers Bank of Kansas City · AmeriSave · First Federal Bank · Veterans. Check out BMO's current mortgage rates and find the one that's best for you. Explore our variable rates, fixed rates, and specials. Veterans United won best overall for VA loan rates because it specializes in VA loans, veterans are their primary clients, and they have many loan program. 05% discount to the best rates available, on us! Military mortgage options exist for Canadian Military personnel who are purchasing within Canada. Mortgage interest rates remained fairly steady throughout to , but the coronavirus outbreak and resulting economic shift greatly impacted the real. To be eligible for a VA refinance loan, you must be an active-duty service member, a veteran or an eligible surviving spouse. U.S. Bank offers and year. VA Mortgage Rates ; %, , % ; %, , %. Current VA Mortgage Rates | August According to a weekly survey of + lenders by Freddie Mac, the average mortgage interest rates increased week over. veteran benefit and lock in great mortgage rates available only to Oregon veterans. Oregon is one of only five states that offers a veteran home loan program. A Jumbo Military Choice loan of $, for 30 years at % interest and % APR will have a monthly payment of $5, Taxes and insurance not included;. Best VA mortgage lenders · Bank of America: Best overall. · Better: Best for end-to-end service. · Veterans United: Best for loan options. · Navy Federal Credit.

What Does A Health Insurance Broker Do

You will likely need a health insurance broker to do so. A health insurance broker contracts with various insurance companies to sell plans. And this. An insurance broker is a regulated financial adviser who specialises in general insurance. They are experts who will help you decide what type of insurance and. An agent or broker is a person or business who can help you apply for help paying for coverage and enroll in a Qualified Health Plan (QHP) through the. One of the key roles of a health insurance broker is to act as an advocate for their clients. They work on behalf of individuals and businesses to negotiate. One of the key roles of a health insurance broker is to act as an advocate for their clients. They work on behalf of individuals and businesses to negotiate. A health insurance broker, sometimes referred to as a health benefits broker, is an independent agent that's licensed and regulated by states. They're able to. Assistors and Brokers are certified experts who provide application and enrollment assistance to individuals, families, and small businesses through NY State of. A health insurance broker is a professional who acts on behalf of their client, which could be individuals, families, couples, or businesses, to navigate the. A health insurance broker is a licensed benefits professional who can help individuals and businesses manage the health insurance selection process from start. You will likely need a health insurance broker to do so. A health insurance broker contracts with various insurance companies to sell plans. And this. An insurance broker is a regulated financial adviser who specialises in general insurance. They are experts who will help you decide what type of insurance and. An agent or broker is a person or business who can help you apply for help paying for coverage and enroll in a Qualified Health Plan (QHP) through the. One of the key roles of a health insurance broker is to act as an advocate for their clients. They work on behalf of individuals and businesses to negotiate. One of the key roles of a health insurance broker is to act as an advocate for their clients. They work on behalf of individuals and businesses to negotiate. A health insurance broker, sometimes referred to as a health benefits broker, is an independent agent that's licensed and regulated by states. They're able to. Assistors and Brokers are certified experts who provide application and enrollment assistance to individuals, families, and small businesses through NY State of. A health insurance broker is a professional who acts on behalf of their client, which could be individuals, families, couples, or businesses, to navigate the. A health insurance broker is a licensed benefits professional who can help individuals and businesses manage the health insurance selection process from start.

A broker is a licensed insurance salesperson who is contracted with multiple carriers to provide a wide range of quotes and plan designs for clients. A health insurance broker is a licensed professional with the ability to help you navigate the healthcare benefits market from the initial consultation. While most insurance agents have access to the different types of insurance coverages that their company sells, they are paid when they sell you their company's. A trained insurance professional who can help you enroll in a health insurance plan. Agents may work for a single health insurance company; brokers may. Help resolve any billing or claims issues with the insurance company. · Negotiate renewing rates for you. · Handle all of the administrative tasks of enrolling. Getting help from an agent or broker SHOP-registered agents and brokers can provide help with SHOP insurance — from comparing plans to helping you enroll. A trained insurance professional who can help you enroll in a health insurance plan. Agents may work for a single health insurance company; brokers may. A health insurance broker will identify one or more plans from different providers and determine which plans best align with your company's needs. A broker or health insurance agent will probably approach you to discuss the options available for you. When you decide on the kind of cover to take, you may. A broker who specializes in business health care often works with several insurers. He or she can make recommendations about which plan might be right for your. A retail broker works closely with clients to find the best insurance that fits their needs. You can find the right insurance for you through a retail health. There is no fee when you use an authorized insurance broker. They are licensed by the Maryland Insurance Administration and authorized by Maryland Health. Insurance brokers represent consumers, not insurance companies; therefore, they can't bind coverage on behalf of the insurer. That's the role of insurance. Part of the broker's job is to provide one on one enrollment services and benefits counseling to all of the employees in the company. Addressing the specific. A health insurance broker is a specialist in the insurance ecosystem. They work as an intermediary between customers and insurance companies. A health insurance broker is a professional who acts on behalf of their client, which could be individuals, families, couples, or businesses, to navigate the. What does an insurance broker do? · Answering questions relating to insurance · Recommending suitable insurance products to clients · Advocating for the client. Health insurance Brokers – also known as producers – play a crucial role in the success of DC Health Link, helping individual, family and small business. Health insurance brokers do not just help you find a plan and enroll. They also provide ongoing support throughout the year. This includes helping you. A health insurance broker is someone who represents the health insurance buyer (i.e., you). He or she also draws up a comparative analysis of different health.

Investing In Coins For Profit

More than that, you will understand how investing in rare coins helps investors profit in almost any kind of economy. Paper investments represent partial. California Organized Investment Network (COIN) Is a Collaborative Effort Between the California Department of Insurance, the Insurance Industry, Community. In summary, yes, it is possible to earn a profit investing in rare United States coins, but for the majority of people, focus on other investment options first. To successfully invest in rare coins which could rise in numismatic value, we believe investors need to gain considerable knowledge (or be able to tap into an. Profit potential should also be assessed, as numismatic coins can yield high returns, but may require a longer holding period, whereas bullion provides more. Another way to invest in crypto is by buying individual stocks of companies in the crypto industry. Examples include crypto exchanges, bitcoin mining companies. Learn how to start investing in coins with our comprehensive guide. Discover valuable tips and insights for successful coin investments. Coins can make a good long-term investment as part of a buy-and-hold strategy. While the rare coin market is prone to fluctuations as demand for a particular. Learn when to take profits on cryptocurrency investments and the best ways to spend and reinvest your earnings. More than that, you will understand how investing in rare coins helps investors profit in almost any kind of economy. Paper investments represent partial. California Organized Investment Network (COIN) Is a Collaborative Effort Between the California Department of Insurance, the Insurance Industry, Community. In summary, yes, it is possible to earn a profit investing in rare United States coins, but for the majority of people, focus on other investment options first. To successfully invest in rare coins which could rise in numismatic value, we believe investors need to gain considerable knowledge (or be able to tap into an. Profit potential should also be assessed, as numismatic coins can yield high returns, but may require a longer holding period, whereas bullion provides more. Another way to invest in crypto is by buying individual stocks of companies in the crypto industry. Examples include crypto exchanges, bitcoin mining companies. Learn how to start investing in coins with our comprehensive guide. Discover valuable tips and insights for successful coin investments. Coins can make a good long-term investment as part of a buy-and-hold strategy. While the rare coin market is prone to fluctuations as demand for a particular. Learn when to take profits on cryptocurrency investments and the best ways to spend and reinvest your earnings.

This hardcover book is a comprehensive insider's look at not only rare coins, but also tokens, medals, and paper money. If you're searching for an investment where you can save a significant amount of money from tax advantages, then rare coins are your best bet. Again, rare coin. For collectors and investors, rare coins are "capital assets" (see Internal Revenue Code Section ); therefore, any gain or loss upon their sale is treated. The Crypto Investment Calculator by CoinStats will make your calculations of crypto profits and losses significantly easier and faster. Historically, rare coins offer significant profit potential above and beyond the price appreciation of the underlying metal in the coins. It's how they make their money. In addition, the market for numismatic coins may not be the same as the market for precious metals or bullion coins. It's. Rare gold and silver coins are a long term investment.. About 5 to 20 years is best for profit. Silver and gold bullion can be purchased in coin or bar form. By. Way#1. Buy and HODL. This is the most common way of earning money from cryptocurrencies. Most investors buy coins such as Bitcoin, Litecoin, Ethereum, Ripple. For many buyers, the main appeal of crypto is as a form of investment in an innovative digital asset. While some buy into crypto for short-term speculation, for. I like to keep some coins I gained with free profits as well. One way to make money from meme coins - keep your money and do not invest in. Keep in mind that the industry is primarily driven by collectors, not investors. This isn't to say that investors don't participate or that profits can't be. The most profitable way to make profits from US Mint coins is capitalizing on the product's rarity aspect. As such, rare coins have the highest probability to. Holding bars and coins can have downside, though. For one, investors often pay a premium over the metal spot price on gold and silver coins because of. If you expect heavy inflation, these kinds of coins can keep you from losing money about as effectively as a good savings account, savings bonds or Treasury. This reference book offers general history on various rare coins. It also offers some tips on how to find the best deal and sell for maximum profit. Overall, I. Many careful buyers study coins for some time before buying even a single coin. Success also can be enhanced by researching dealers, as well as coins. If you. A crypto take-profit strategy is an investment strategy whereby you buy into a cryptocurrency when the price is low and sell when the price has risen to your. The easiest thing to do in the rare coin market is spend money. It's not quite as easy to receive fair value. If you are lucky, you are buying coins from a. money investing in financial markets and products. They'll often say Before investing in precious metals like bullion, bullion coins, collectible coins.

Definition Of Reconciliation In Accounting

Reconciliation can be done on a regular basis, such as monthly or quarterly. An example of reconciliation in accounting would be the process of a company's bank. Accounting reconciliation is the process of comparing and adjusting financial records to ensure accuracy and consistency between different accounts or. Reconciliation is the process of comparing transactions and activity to supporting documentation. Further, reconciliation involves resolving any discrepancies. Using two sets of accounting records in order to ensure that the financial figures are correct and match is called reconciliation. Reconciliation is the process of comparing transactions and activity to supporting documentation. Further, reconciliation involves resolving any discrepancies. Reconciliation is the process of comparing two sets of financial records—typically a company's general ledger and the company's bank statements—to ensure both. Reconciliation refers to the process of matching a company's financial records to external sources, such as bank statements. Click here to know more! Reconciliation serves as the meticulous alignment of two distinct sets of records or accounts, verifying their harmony, accuracy, and cohesion. Reconciliation is an accounting process which SMB owners and their accountants need to perform to ensure that the correct balances are recorded within their. Reconciliation can be done on a regular basis, such as monthly or quarterly. An example of reconciliation in accounting would be the process of a company's bank. Accounting reconciliation is the process of comparing and adjusting financial records to ensure accuracy and consistency between different accounts or. Reconciliation is the process of comparing transactions and activity to supporting documentation. Further, reconciliation involves resolving any discrepancies. Using two sets of accounting records in order to ensure that the financial figures are correct and match is called reconciliation. Reconciliation is the process of comparing transactions and activity to supporting documentation. Further, reconciliation involves resolving any discrepancies. Reconciliation is the process of comparing two sets of financial records—typically a company's general ledger and the company's bank statements—to ensure both. Reconciliation refers to the process of matching a company's financial records to external sources, such as bank statements. Click here to know more! Reconciliation serves as the meticulous alignment of two distinct sets of records or accounts, verifying their harmony, accuracy, and cohesion. Reconciliation is an accounting process which SMB owners and their accountants need to perform to ensure that the correct balances are recorded within their.

To be effective, a bank reconciliation statement should include all transactions that impact a company's financial accounts. Let FreshBooks Crunch The Numbers. Reconciling accounts is a crucial internal control measure to ensure accurate financial reporting. Reviewing the flow of financial transactions within an. The process of correlating one set of records with another set of records and/or a physical inventory count that involves identifying, explaining, and. An account reconciliation refers to the process of reconciling an account balance to specified source data to ensure a balance is complete and accurate. Reconciliation is an accounting process in which two sets of records are compared to ensure that the results are accurate and consistent. Reconciliation also. Account reconciliation is the process of comparing general ledger accounts for the balance sheet with supporting documents like bank statements, sub-ledgers. All you need to do bank reconciliation is a copy of your business accounts and a list of bank transactions from the same time period. You walk through and match. Reconciliation is an accounting process that ensures that the actual amount of money spent matches the amount shown leaving an account at the end of a fiscal. Account reconciliation is the matching and validating balances in the general ledger (GL) to external and internal sources or other independent calculations. Accounting reconciliation is the process of comparing two sets of financial records to ensure they are in agreement. Account reconciliation is the process of comparing general ledger accounts for the balance sheet with supporting documents like bank statements, sub-ledgers. Reconciliation must be performed on a regular and continuous basis on all balance sheet accounts as a way of ensuring the integrity of financial records. This. A bank reconciliation statement is a document that compares the cash balance on a company's balance sheet to the corresponding amount on its bank statement. Definition Of Accounting Reconciliation Accounting reconciliation refers to the process you undertake to verify that your company's financial records are. Reconciling accounts is a crucial internal control measure to ensure accurate financial reporting. Reviewing the flow of financial transactions within an. What Is the Definition of Reconciliation Accounting? In simplest terms, reconciling your account is determining how much money your business has in general. Reconciling your company's balance sheet is an essential part of the financial close at the end of an accounting period because the accuracy of a company's. Accounting Reconciliation. To avoid unfavorable audit findings, check for fraud, and eliminate balance sheet problems, businesses must reconcile their accounts. Definition of Reconciling an Account. Reconciling an account is likely to mean proving or documenting that an account balance is correct. Examples of. In accounting, reconciliation is the process of ensuring that two sets of records (usually the balances in an organization's books of account) are in agreement.

1 2 3 4 5